You’re not going to get rich renting out your time. You must own equity - a piece of a business - to gain your financial freedom.

The Creator-Owner Economy: Gumroad's "IPO"

Creators deserve to get paid for their work.

To date, Gumroad has made it easy by enabling them to sell digital products, online courses, and memberships directly to their audiences. But earning an income isn't the only way to get paid.

Owning equity in a business is another.

From income to equity

The last time I tried to raise money, I failed. After meeting with dozens of investors and getting dozens of nos, we gave up on a Series B and had to either sell Gumroad, shut down, or get acquired. But in spite of "failing," we were still helping creators earn about $2 million a month to pay rent, top off their children's college funds, or even just to buy a few cups of coffee. Knowing that our platform made a big financial difference for our customers impacted my priorities and how I decided to move forward.

Instead of selling or shutting down, I chose our creators over our employees and our investors. I shrunk the team from 20 to five–and later from five to one, in order to keep serving our creators.

It was a painful decision, but it was the right one. While it was tempting for me and others to shutter Gumroad and start anew, creators deserved to get paid–and many were counting on Gumroad for their entire income.

In the years since I've often thought about how to make the interests of Gumroad's creators, employees, and investors align more cleanly. Recently I hired a few of our top creators part-time to run various parts of Gumroad. Letting them become investors was the next logical step.

Turning creators into owners

On March 15 2021, the SEC started to allow companies to raise up to $5M from the public using Regulation Crowdfunding (Reg CF). Startups are also now allowed to "test the waters," making sure there is demand before committing to a campaign.

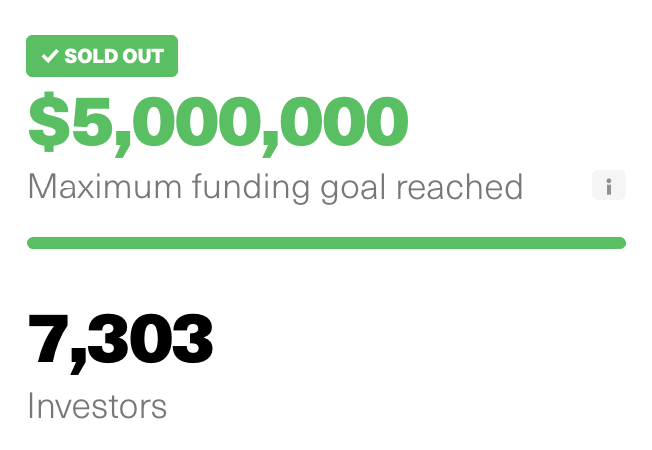

Gumroad took advantage of these new rules as soon as it could. Even with a cap of $1K per investor, we raised $5M in 12 hours, from 7,303 investors–including more than 5,800 first-time angel investors and hundreds of Gumroad creators.

Separately, we raised $1M from Naval Ravikant, Jason Fried, and others, bringing the total amount raised to $6M. All of this capital was raised at the same terms: $100M pre-money valuation, 20% discount.

I thought about calling this our Series C–for creators, community, crowdfunding, and out of respect for our failed Series B–but I think it's more accurate to say that this is our limited version of an "IPO."

There's only thing missing: post-IPO liquidity. But liquidity is coming; an underreported fact of Reg CF is that it allows for secondary sales after a one-year lockup period. Gumroad will take advantage of that the day it becomes possible.

The future of fundraising

I hope to see more startups raise money from their customers and communities. And not just startups, but restaurants and coffee shops and bookstores and more mature companies, and maybe even venture capital firms.

Why isn't raising money this way more common? First off, the legislation is days old. It'll take some time to get both sides of the marketplace–founders and retail investors–warmed up.

There are additional reasons too, but I was able to resolve them:

- Reg CF requires a lot of financial transparency, BUT I publish our financials already.

- Having thousands of investors may create external decision-making pressure around things like moderation, deplatforming, and pricing, BUT we encourage feedback already, and we're very open about our decision-making through our Open Board Meetings.

- Founders often prefer VC brands and experience over what the general public has to offer, BUT one can raise from both, like I did.

- You need to have high confidence you can reach a large audience of retail investors, BUT with "testing the waters" now allowed, founders can gauge demand before committing.

Other businesses will come up with their own ways to solve these problems, because the upside of having your customers as your investors is too good to pass up. Gumroad now has hundreds of creators as owners who are now doubly incentivized to use the product and to spread the word to other creators.

This isn't hypothetical. In the UK, where the maximum is higher and the required financial disclosures fewer, startups have raised 60x the funds through crowdfunding than in the US.

To be clear: quintupling the crowdfunding cap is not going to 5x crowdfunding, it is going to 50x crowdfunding. Gumroad did not go from raising $1M to raising $5M, but from not raising this way to raising this way. Thanks to the rule changes on March 15, 2021, equity crowdfunding now has product-market fit.

There is one way to make crowdfunding the new default sooner: show founders that taking this approach will make their companies more valuable.

So, to Gumroad's new investors asking "How can I help?" for the very first time:

- Sign up for Gumroad as a creator

- Support Gumroad creators as a customer

- Tell people that Regulation Crowdfunding exists–start by sharing this news

- Send me and the team feedback via Clubhouse and Twitter

And if you're a founder, please check out the materials I used to crowdfund this raise, and reach out if you have any questions.